Iflexion became a long-term partner of the startup, developing their claim management software as a service and helping raise £1 million in funding.

Claim Management Software for a UK Startup

Context

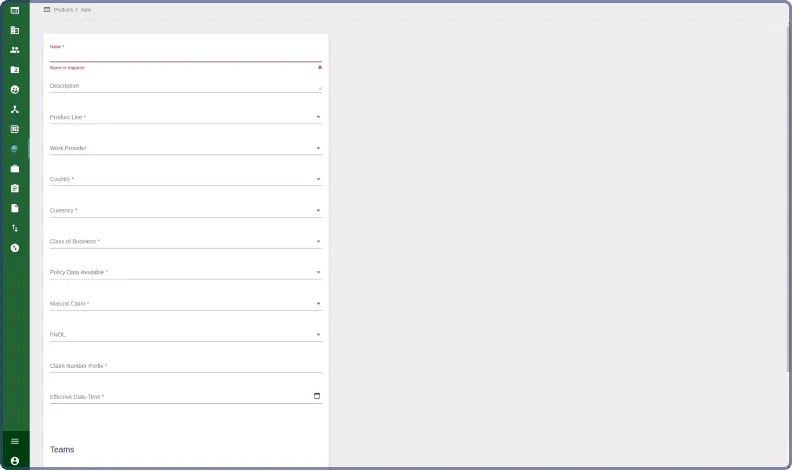

Our customer, a UK startup, turned to Iflexion for web application development services, having high-level requirements for their product, an insurance claim management SaaS. The insurance software was to cover the complete cycle of creating, storing, and managing claims, be highly customizable, and available on the pay-per-use basis to its end users, insurance companies.

Solution

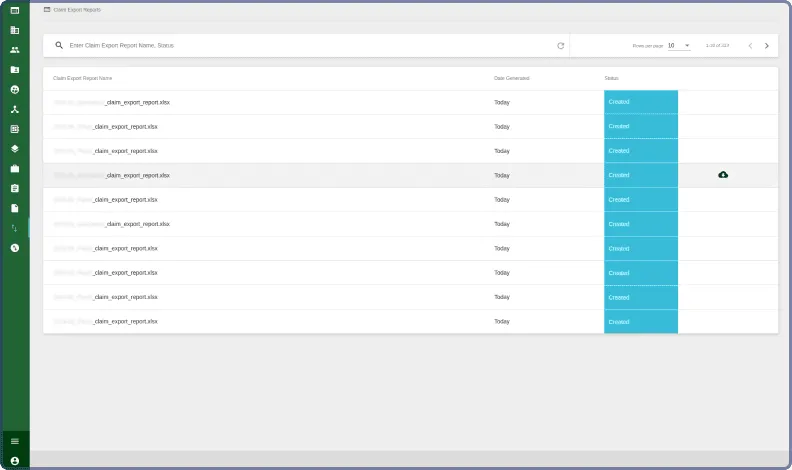

The solution delivered by Iflexion is a distributed web application for creating, storing, and managing insurance certificates and claims, as well as generating reports according to the rules predefined by the application’s end users.

The Case Management Portal

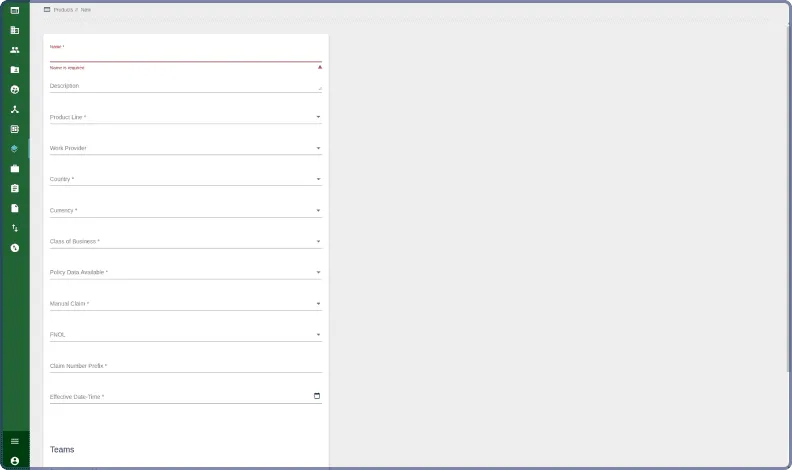

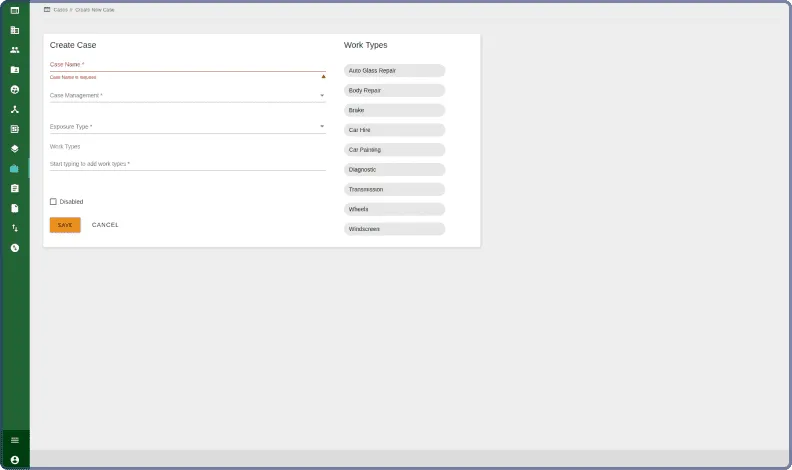

Cases represent insured events, for instance, a car accident. In the event of an accident, the application triggers a predefined claim management workflow that includes fact-finding, describing participants’ actions, etc. Each case is configured according to the internal processes of an insurance company that works with it.

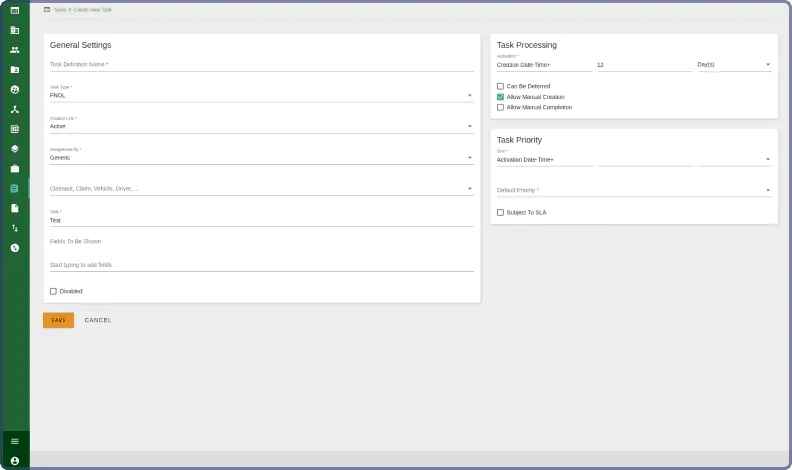

The case management portal is represented by a dynamic UI with two main forms: First Notice of Loss (FNOL, an initial report sent to an insurance company after a loss or damage of an insured asset) and Claim (a formal request for compensation validated by an insurance company). As soon as an insurance claim is created, the solution generates both forms.

Users can configure the FNOL form by adding the fields they need. The information initially collected in this form is used for further claim processing.

Creating a new case

FNOL form creation and task settings

Multitenancy

Multitenancy

A tenant is a client (an insurance company) using the application. The number of tenants supported by the application is unlimited. All tenants work directly with the application, and there is no need to set up a new environment for each new client.

Tenants work with their own databases, which allows distributing tenants’ data across multiple locations. This isolates personal information and ensures compliance with the security requirements. In its turn, the application simultaneously works with numerous databases.

Tenants are added by our customer’s employees, who also manage subscriptions and define the cost of licenses individually for each subscribing insurance company, as the pricing depends on the functionality chosen by a tenant.

When a new tenant is created, the solution automatically generates a primary user with the “super admin” rights. This user is able to create roles and define permissions according to their company’s business processes.

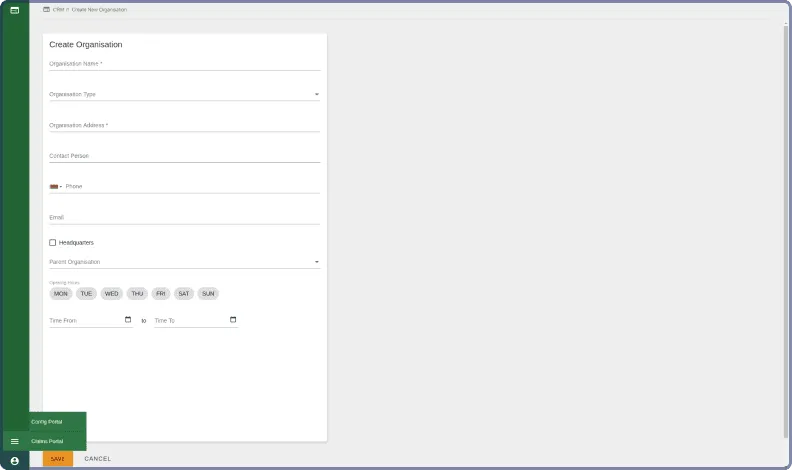

Every tenant has access to the three interconnected portals that make up the SaaS platform:

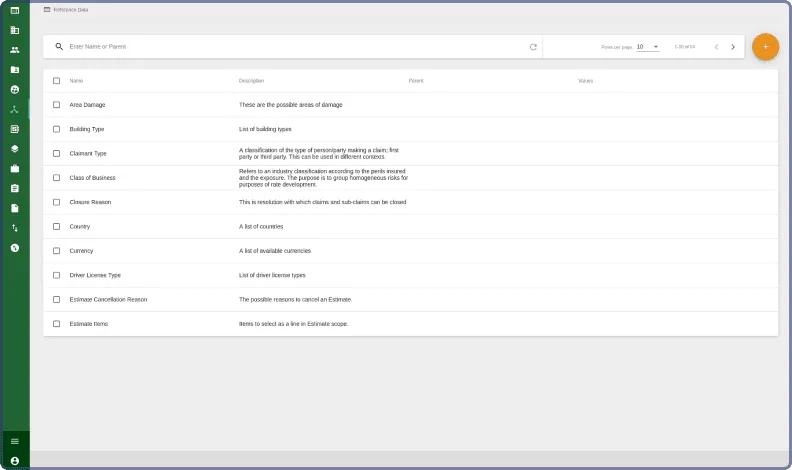

- The case configuration portal for insurance case setup, creation and management of user roles, and permission-based authorization.

- The case management portal for processing the configured cases.

- The CRM portal with a variety of entities (e.g., account contact data, corporate handbooks, etc.), which are used within the configuration and case management portals.

Each tenant sets up the case configuration portal according to their company’s requirements, which covers the customizations of the data model, custom FNOL and Claim views, service offerings, and more. Tenants can add individual users and teams, add questions on the FNOL form, and define their claim processing strategies. Configured cases are then published to the case management portal.

Users can also choose whether their tasks should be created and fulfilled automatically when a certain event occurs or should only be created and fulfilled manually.

Creating a new organization in the CRM system

IoT Data Processing

Lately, Iflexion’s team has been continuously working on incorporating data from sensory devices into the claim management workflows. IoT-sourced information is valuable for investigating insured accidents faster and more precisely, while also helping the platform stand out on the market more prominently.

Technologies

Java became the key technology of the solution due to its well-developed ecosystem, easy upgrade to new versions, and the codebase stability of its libraries and frameworks. Further into the project, we also complemented it with Kotlin to create new functionality.

Kotlin has all the advantages of Java while also being newer, allowing for faster development, ensuring better code maintainability and readability by being more concise, and preventing common development errors by design.

The system is event-based as it has to be fail-safe and continue functioning in the event of certain services being unavailable. The communication between the solution parts through the events provides for higher fail-safety than through traditional REST APIs.

Microservices

The solution is based on microservices with a service-oriented architecture (SOA). This approach allows developers to quickly add new functionality, make changes, update the library and framework versions, flexibly manage the performance, and scale.

The microservices are represented by modules responsible for certain parts of the functionality. For instance, there are microservices for email processing, managing notification messages, and more. The modules are grouped according to their functions and delivered as admin, claim, configuration, CRM, supplier, and API portals.

Third-party Integrations

The solution is integrated with third-party systems, which are implemented as independent services to guarantee a high level of support.

To enable in-system communication with the insurance claimants for the purposes of gathering information about insured events, the application is integrated with Gmail and Office 365 (via the Outlook Mail REST API) for mail synchronization, as well as Twilio for sending and receiving text messages to/from a tenant’s phone number.

We also integrated the solution with ExifTool for adding comments to images in the form of metadata, Froala Editor for WYSIWYG text editing, Google Maps JS API for finding addresses via Google Maps, and Loqate for checking the correctness of a stated address.

Continuous Integration & Code Review

To monitor and ensure the technical health of the project, we set up continuous integration and code review. We employed the following tools:

- SonarQube for source code quality management

- Checkstyle for static code analysis

- PMD for source code analysis

- FindBugs for finding defects in Java code

- Detekt and Ktlint for Kotlin code analysis

- TSLint for checking TypeScript code for readability, maintainability, and functionality errors

Process

Iflexion’s team was involved throughout the requirements analysis, claim management software development, and testing. In the two years of cooperating with the startup, our dedicated team has grown tenfold, from 4 to 40 specialists, who include business analysts, software engineers, manual and automated testing experts.

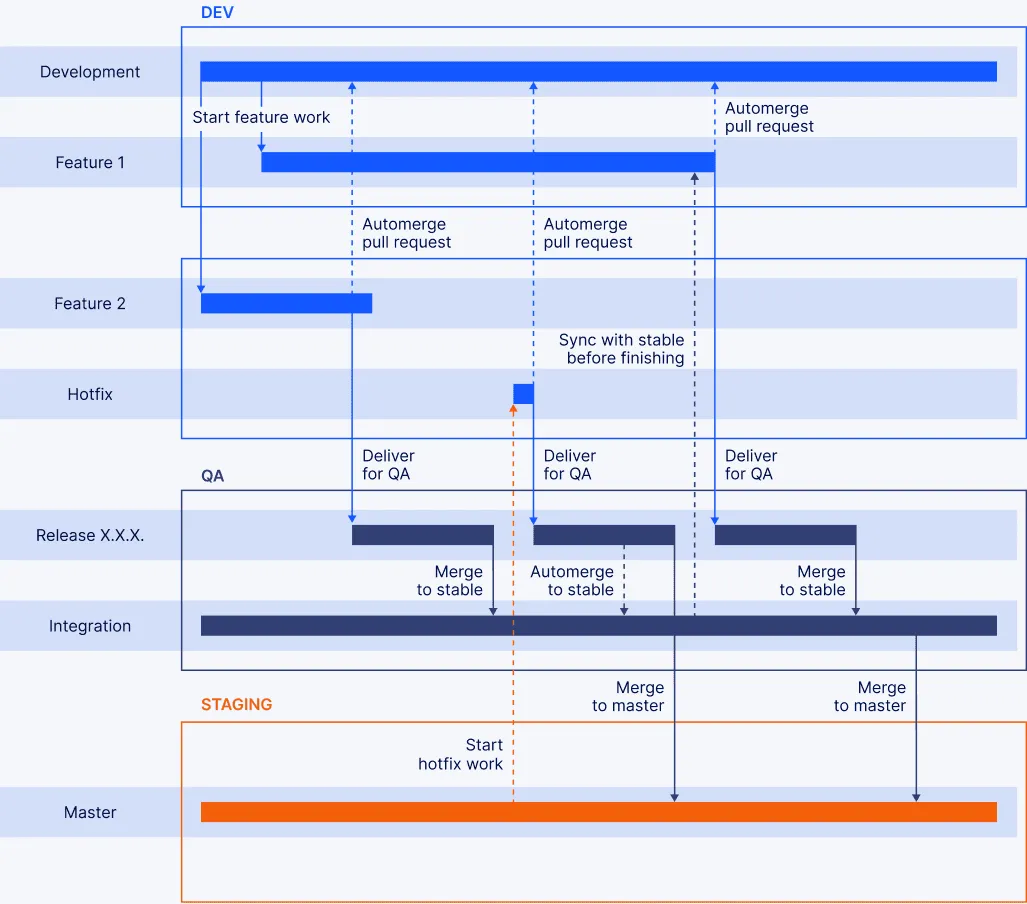

Kanban for Lean Startup

In line with the customer’s adopted lean startup methodology, we set up continuous deployment and iterative product releases to cut down development cycles and speed up the product’s viability discovery. This way, we could deliver the solution using a limited amount of resources while assessing end users’ specific requirements.

As project tasks were coming on a rolling basis and were highly dynamic, we gradually moved to the Kanban methodology instead of Scrum that was adopted initially, and introduced the by-feature release schedule.

Release process

We practiced quarterly planning to reduce the stress and increase productivity, with the customer visiting our development center for planning sessions every three months.

Results

Iflexion developed a scalable and highly customizable claim management software-as-a-service platform that consists of three portals and covers the full cycle of insurance claim processing.

The product is now in use by insurance SMBs and large corporations. The users highlight its ease of use, speed and flexibility, which allow them marketing their insurance offers quickly while providing outstanding customer experience.

The startup went on to raise £1 million in series B funding and continues developing their claim management platform with Iflexion as their technology partner.

Screenshots

Showing 1 to 1 of 3